Dear Commission,

We would like to thank the Archbishop and the other members of the commission for establishing this important and urgent enquiry into the structure and the future of our societies.

Please find attached the submission to your commission from the LIFE Party.

In the submission we establish that the direction accomplishment of our stated objectives of a just and good society, delivers a much more effective solution than attempts to set wages. And universal services provide enormous economic benefits for our society that are not available through the pursuit of the same objectives via the means of wage manipulation.

We would also be happy to provide oral evidence to the commission should you wish.

The details behind the summary on the attached document can be found at http://www.uklife.org/wellfair.

LIFE, July 2013

Living wage – a fatal distraction

Solving the problem of affordable social democracy

The desire to impose a living or minimum wage on the economy is merely a substitute for the provision of the universal social support that is our real responsibility. The intention to assert a minimum or living wage both involve coercion, one of the provider of labour, and the other of the employer.

A Standard of life

The real objective

In the pursuit of a “living wage” we must first acknowledge that our real objective is the support of a basic standard of life for all members of our community and society. What we are seeking is the creation of a floor to living standards that defines our social contract, a minimum standard of life below which we will not let our neighbours fall. That social contract is properly defined in terms of shelter, sustenance and basic services such as health, care, education and information access.

We only use money as a substitute measure when we imagine that we cannot deliver the services themselves. But this is only a failure of imagination and effort – there is no real, practical barrier to delivering all basic needs as services.

Losing before we start

If we define the quality of life in money, we have lost the battle before the battle has begun. The pursuit of a living wage, defined in monetary terms, is a distraction from the true goal. The pursuit of a living wage is to entrust Caesar with responsibilities that are not his, and which he cannot be held to.

Naturally efficient

Universal services automatically prioritise efficient use of resources, because they tend naturally toward the lowest cost means of delivering the services to everyone.

So Nearly there

We already deliver much of the social contract as services

In the UK we already provide free access to health and education to everyone, and we provide free shelter, transport and sustenance for subsets of our society.

We can extend the basic services to every person in need of them with little additional effort, and no additional cost in the medium term. We spend £500Bn a year on social services today, and the same budget will allow us to deliver the services universally, after removing the waste and overhead of centrally-administered, means-tested benefit programs. See uklife.org/wellfair-budget for detailed costing using JRF MIS.

A free bus pass for everyone, community kitchens providing locally-sourced, healthy food, and basic phone & Internet will do it!

Economic emancipation

Growth and prosperity unleashed

When we deliver on our social contract with services, we liberate everyone to participate in the wealth economy at the level and pace that they desire – without coercion of either labour or employer. Universal services eliminate the “benefit trap” caused by means-testing, and reinforce the incentive to contribute.

Free local transport and enhanced communications are lifeblood to small and micro businesses. Flexible, socially secure labour is a boon to all enterprise.

A million micro economic contributions are liberated, enriching our lives, demoting consumption and adding economically valuable activity that is otherwise left undone.

No subsidy necessary

Once we take responsibility for delivering our social contract, we will not have to subsidise businesses to create employment. Businesses will have to offer sufficiently attractive pay and conditions to attract workers in a functioning market.

Labour costs

Reduced labour rates make infrastructure investments affordable

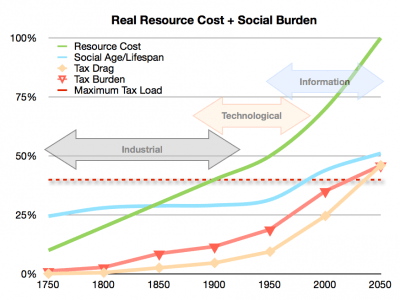

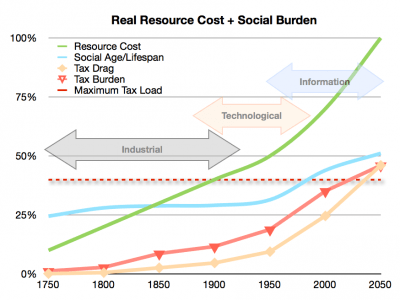

Whereas the enforcement of minimum wages push up the monetary costs of investment, providing universal services reduces the cost of labour, in monetary terms, and makes building new housing, upgrading our energy infrastructure, and other social investments more affordable from a reasonable tax on wealth.

“Just and Good Society”

Eyes on the prize! It is the just and good society that we seek, and it is only the trance of money that leads us to describe the objective in terms of money. Solving the problem of how to deliver affordable social security is not only an economic imperative, it will also deliver the broad social justice we are seeking.

“Why aren’t those who are profiting from their workers paying up?”

It is illogical to ask a profit-orientated corporation to voluntarily increase its costs. It’s like asking a snake to jump.

It is our responsibility, as fellow citizens, to meet our own social needs. We are society, we are the ones in charge!

“At the end of the day, what workers really need is pay, not platitudes.”

Not true. At the end of the day, what everyone really needs is community, not cash. We must shed our illusion that cash can replace a social bond that recognises and respects our mutual interdependence.

Economic suicide

Our economy has been seriously destabilised by futile attempts to replace real security rooted in a social contract, with the false security of material wealth.

The reason we rescued the banks in 2008 was to protect the money in pensions. The reason we are inflating house prices and stock markets now is to use cash to try and create employment and rebuild social fabric.

We simply cannot force our economy to do our social work.

You must be logged in to post a comment.